The world’s reserve currency is the primary currency used for global trade. The U.S. has enjoyed reserve currency status for about 70 years (if you mark its ascension by the 1944 Bretton Woods agreement). And that’s given the U.S. the ability purchase foreign goods and services more cheaply than other countries.

For more than a decade now, there’s been speculation that the U.S. dollar is on its way out as the world’s reserve currency. The problem, of course, is that there isn’t a great replacement. Before the emergence of digital currencies, the consensus seemed to be that the global reserve currency should actually be a basket of currencies that trade as a group.

With the emergence of ripple (XRP), though, I’ve been thinking more and more about how it could actually serve as a reserve currency and offer numerous advantages over the dollar or a basket of currencies.

Ripple and international trade

Ripple diminishes one of the primary needs for a reserve currency: that of giving two countries with different currencies a common medium of exchange. It does that by virtue of functioning as an instant exchange (via the ripple protocol). That lets trading partners transact in whatever currency they want. For example, a manufacturer in China might want to sell its iPods to a buyer in Mexico for pesos. Using ripple, the buyer could place a buy order in pesos, and the ripple exchange would automatically convert the pesos to yuan for delivery to the seller in China.

This solves the technical problem of needing a medium of exchange that both parties accept, but it still subjects both the buyer and seller to sometimes volatile exchange rates. Remember, one of the reasons countries buy foreign reserves is so that they can trade without the need to exchange currencies.

That’s where ripple as a currency (i.e. XRP) comes into play. If the seller in China and the buyer in Mexico both held ripple in reserve, they could do their transaction instantly. The buyer would pay in ripple and the seller would walk away with ripple. The seller could then hold onto that ripple or use it to buy yuan. This transaction is fast and smooth and it eliminates the need to pay exchange rates.

Arguments against ripple as a reserve currency

There are a few factors that might prevent ripple from serving as a global reserve currency:

- Reserve currencies need stability. Volatility is the enemy of central banks. Extreme volatility in a reserve currency can obviously impact local currencies, which is bad for business, bankers and politicians.

- Lack of centralization. It’s hard to imagine governments around the world might cede control over their reserve currency to what amounts to a peer-to-peer network.

- Market depth. 100 billion ripple might be enough to function as a reserve currency (since it can be broken down into fractions), but only 30% of the ripple in the world are actually in circulation. Ripple Labs still hold more than 70 billion ripple (source).

- Ripple is purely digital and therefore dependent on a functioning internet.

Arguments for ripple as a reserve currency

Let’s rebut the arguments against ripple as a reserve currency:

- Stability will come as ripple matures. And, ripple could actually prove less volatile than alternatives like the dollar as it’s finite (at 100 billion ripple), and it isn’t subject to inflation or political and military risks.

- Lack of centralization diminishes risk by not relying on the stability of a single country or government. Civil war or a terrorist attack in the U.S. for instance, could cripple the dollar.

- Market depth. Ripple has pledged to pay out or give away all of its holdings as it builds out the ripple network. More than 7 billion ripple have been distributed to date. There’s no set schedule when the rest will be distributed, but they will continue to be released over time.

- Yes, ripple requires an open and functioning internet, but so do most large modern financial transactions.

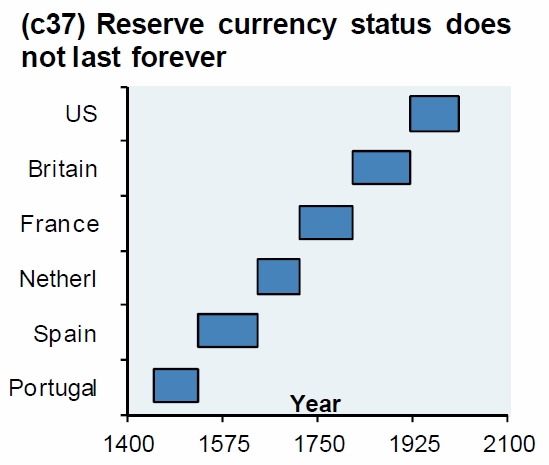

In the end, you’ve got to remember that nothing lasts forever:

While we’re a long way from seeing ripple supplant the dollar as the global reserve currency, it does offer obvious advantages over relying on uncapped, government-controlled fiat currencies. If ripple meets its goal of becoming the de facto financial exchange protocol, I don’t see any reason why it wouldn’t be used as the world’s reserve currency. So what does that mean for ripple’s future value? Check out my post Ripple price prediction (XRP).

Chart source: Zerohedge.

Can't miss cryptocurrency news!

- Bitcoin’s ‘Wall Street Phase’ just around the corner

- Ripple Labs to sue Kraken CEO?

- Analyzing Jed McCaleb’s departure and the ripple currency plunge (XRP)

- Altcoin ETF could radically alter cryptocurrency space

- Bitcoin price prediction (BTC)

- Ripple and Fidor just changed cryptocurrency forever

- In 5–10 years, a ripple address will be as normal as email'

- 10 professional bitcoin price predictions

- Ripple price prediction (XRP)

- Satoshi Nakamoto quotes

- The 218 most popular cryptocurrencies by social media presence

- How I became a Bitshares believer

- Litecoin price prediction (LTC)